Service details

- Home

- FIN622 – Corporate Finance

FIN622

FIN622 – Corporate Finance

Corporate Finance provides in-depth knowledge of how businesses manage their financial resources to maximize shareholder value. Students learn the time value of money using financial mathematics to calculate present and future values, annuities, and perpetuities. The course emphasizes investment decision-making through tools like Net Present Value (NPV), Internal Rate of Return (IRR), Payback Period, and Profitability Index. Students analyze how firms raise capital through equity, debt, or hybrid instruments, and determine the optimal capital structure that minimizes the weighted average cost of capital (WACC). Topics like dividend policy, retained earnings, leasing vs. buying, and corporate governance are covered with real-world case studies. Risk analysis is a core component — students learn to evaluate systematic and unsystematic risk, use CAPM (Capital Asset Pricing Model), and construct efficient portfolios. The course also explores working capital management, cash budgeting, and financial statement analysis using Excel. Learning Outcomes: Students will develop skills in strategic financial planning, investment analysis, and value creation, making them suitable for roles in investment banking, financial consultancy, or corporate treasury.

Other Services

-

MKT501 – Marketing Management

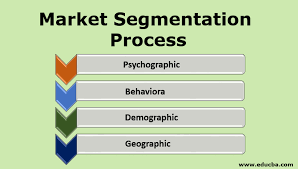

Marketing Management explores the complete marketing process from strategy to execution. Students learn about consumer behavior, market research techn...

-

ENG301 – Business Communication

This course teaches effective communication tailored to business settings. It begins with the basics of business writing, including emails, memos, let...

-

MGT611 – Business Ethics

This course focuses on identifying and resolving ethical dilemmas in business. Students study ethical theories (utilitarianism, deontology, virtue eth...

-

MGT631 – International Business

This course examines how businesses operate across borders in an increasingly globalized economy. It starts with international trade theories (e.g., c...

-

MGT603 – Strategic Management

Strategic Management is a capstone course that brings together all functional areas of business to formulate and implement cohesive strategies. It tea...

-

MGT602 – Entrepreneurship

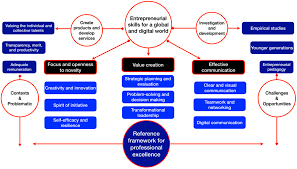

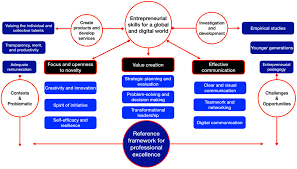

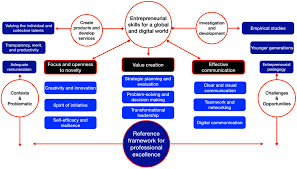

This course nurtures entrepreneurial thinking by taking students through the complete startup lifecycle — from idea generation to business launch. Stu...

-

CS615 – Mobile Application Development

This course introduces the design and engineering of mobile applications, focusing on both native (Android/iOS) and cross-platform development. Studen...

-

CS420 – Data Science

Data Science is a multidisciplinary field that combines programming, statistical analysis, and domain expertise to extract meaningful insights from st...

-

CS415 – Software Project Management

CS415 – Software Project Management (SPM) is a professional-level course offered in the BS Computer Science program at Virtual University. It focuses...

-

CS418 – Machine Learning

CS418 – Machine Learning is an advanced-level course in the Computer Science curriculum at Virtual University, designed to introduce students to the f...

-

CS419 – Final Year Project (FYP)

The Final Year Project (FYP), coded as CS419 (or CS619 on LMS), is the culminating course of the BS Computer Science program at Virtual University. It...

-

CS403 – Database Management Systems

CS403 – Database Management Systems is a foundational course designed to provide students with a deep understanding of how data is stored, organized,...

-

ZOO515

Welcome to Jobkle.com! Here you can download ZOO515 – Developmental Biology handouts in PDF format, specially designed for Virtual University students...

-

MTH632

Welcome to MTH632 - Advanced Probability Theory at the Virtual University of Pakistan. This resource center is intended to give students with crucial...

-

MTH631

We welcome you to the Virtual University of Pakistan's MTH631 - Probability and Statistics program. This site is intended to give students with vital...

-

MTH623

Along with subjective information, we give objective elements such as multiple-choice questions, quizzes, and important topic summaries. These materia...

-

MTH601

We welcome you to the Virtual University of Pakistan's MTH601 - Differential Equations platform. This resource center is intended to give students wit...

-

MTH401

We welcome you to the Virtual University of Pakistan's MTH401 - Algebra platform. This specialized section provides students with critical study tools...

-

MCM604

MCM604 vvvvv

-

MGT510

If you are studying MGT510 (Total Quality Management) at Virtual University of Pakistan, you have come to the perfect location for all of your study r...

-

ENG201

If you are a student of ENG201 (Business and Technical English Writing) at Virtual University of Pakistan, you've come to the perfect location for stu...

-

ENG101

Looking for study materials for ENG101 (English Comprehension) at the Virtual University of Pakistan? You have arrived to the correct location! Access...

-

EDU654

Attention, EDU654 Students: Welcome to EDU654 at the Virtual University of Pakistan! To enhance your learning experience and promote your academic...

-

EDU604

Attention, EDU604 Students: Welcome to EDU 604 at the Virtual University of Pakistan! To help you succeed in this course, we have provided a variet...

-

EDU601

Consideration EDU601 Students: Welcome to EDU601 at Virtual University of Pakistan! To bolster your scholarly travel and guarantee you have the bes...

-

EDU501

Imperative Take note for EDU501 Students: Welcome to EDU501 at Virtual University of Pakistan! To encourage your ponders and guarantee you have all...

-

EDU433

Welcome to the EDU4330 resource center for students at Virtual University of Pakistan. This area is dedicated to providing you with the necessary stud...

-

EDU430

Greetings and welcome to the Virtual University of Pakistan's EDU430 resource portal! You may get all the study tools you need on one website, includi...

-

EDU406

Welcome to the Virtual University of Pakistan's EDU406 resource center for students! For both subjective and objective study tools that will help you...

-

EDU402

Welcome to the EDU402 asset center for understudies of Virtual University of Pakistan! This page is planned to offer comprehensive ponder materials, c...

-

EDU304

Welcome to the EDU304 asset center for understudies of Virtual University of Pakistan! This page is planned to offer you all the basic think about mat...

-

EDU303

Greetings from the EDU303 resource center for Virtual University of Pakistan students! This website has been designed to facilitate your access to bot...

-

EDU302

Greetings and welcome to the Virtual University of Pakistan's EDU302 resource portal! This website is intended to give you the necessary study tools t...

-

EDU301

Welcome to the EDU301 asset center for Virtual College of Pakistan understudies! This page is devoted to giving you with fundamental consider material...

-

EDU201

All Students of Virtual University of Pakistan Welcome to the EDU201 resource centre! The scope of this page is to ensure that you locate the necessar...

-

Cs607

This is the CS607 resource center. This page contains study notes and study resources whether subjective or objective. This is actually the center for...

-

Cs605

Welcome to the CS605 resource hub for students at Virtual University of Pakistan! This page has been created in order to furnish you with the importan...

-

CS604

Welcome to the CS604 asset center for Virtual University of Pakistan understudies! This page is devoted to giving you with comprehensive consider mate...

-

CS601

Welcome to the CS601 asset center for understudies of Virtual University of Pakistan! This page is uncommonly planned to give you with all the fundame...

-

CS502

Welcome to the CS502 asset center at the Virtual University of Pakistan! This page is committed to giving understudies with comprehensive think about...

-

CS408

Welcome to the CS408 asset center for Virtual University of Pakistan understudies! This page is made to offer assistance you get to the best ponder ma...

-

CS402

Welcome to the CS402 asset center for Virtual University of Pakistan understudies! If you’re considering this course and require get to to high-qualit...

-

CS304

Welcome to the CS304 asset center at the Virtual University of Pakistan! This space is committed to giving understudies with the basic ponder material...

-

CS302

Welcome to the asset center for CS302 at the Virtual University of Pakistan! If you're a understudy looking for comprehensive think about materials, y...

-

CS205

Welcome to the asset center for CS205 at the Virtual University of Pakistan! This space is uncommonly planned for understudies who are looking for com...

-

CS204

Welcome to the devoted asset page for CS204 at the Virtual University of Pakistan! If you're a understudy looking for high-quality ponder materials to...

-

CS610

Welcome to your go-to center for CS610 assets at the Virtual University of Pakistan! If you're looking for well-organized consider fabric to exceed ex...

-

Mth603

This is the MTH603 page for students of Virtual University (VU). A Page Where You can Find Necessary Study Material and Handouts to prepare your MTH60...

-

MTH501

Welcome to the MTH302 page, planned for understudies of the Virtual University of Pakistan. This stage gives a wide extend of notes and ponder materia...

-

MTH302

Welcome to the MTH302 page, planned for understudies of the Virtual University of Pakistan. This stage gives a wide extend of notes and consider mater...

-

MTH202

Welcome to the MTH202 asset page, particularly made for Virtual University of Pakistan understudies. This page is planned to offer assistance understu...

-

MTH001

Welcome to the MTH001 page, devoted to giving fundamental notes and consider materials for understudies of the Virtual University of Pakistan. Whether...

-

CS609

Welcome to our stage for CS609 - Framework Programming at the Virtual College of Pakistan. This stage is uncommonly planned to give understudies with...

-

CS606

Welcome to our stage for CS606 - Compiler Development at the Virtual College of Pakistan. This space is planned to offer understudies fundamental pond...

-

CS602

Welcome to our asset center for CS602 - Computer Design at the Virtual College of Pakistan. This stage is devoted to giving understudies with profitab...

-

CS508

Welcome to our committed stage for CS508 - Present day Programming Dialects at the Virtual College of Pakistan. Here, we give basic consider materials...

-

CS507

Welcome to our stage for CS507 - Data Frameworks at the Virtual College of Pakistan. This asset center is outlined to give understudies with basic pon...

-

CS506

Welcome to our asset center for CS506 - Web Plan and Improvement at the Virtual College of Pakistan. This stage is committed to giving understudies wi...

-

CS504

Welcome to our devoted stage for CS504 - Program Building at the Virtual College of Pakistan. This space is planned to give understudies with the fund...

-

CS411

Welcome to our asset center for CS411 - Visual Programming at the Virtual College of Pakistan. This stage is devoted to making a difference understudi...

-

CS401

Welcome to the CS304 Asset Hub! Welcome to our stage, committed to giving basic consider materials for CS401 - Computer Engineering and Gathering D...

-

CS301

If you're selected in CS301 at the Virtual College of Pakistan and looking for think about notes, you've come to the right put! We offer a collection...

-

CS201

If you're a understudy of CS201 at the Virtual College of Pakistan and looking for comprehensive consider materials, you’re in the right put! We give...

-

CS101

If you're examining CS101 at the Virtual College of Pakistan and require dependable consider materials, you’re in the right put! We get it how vital i...

-

CS001

If you're a student enrolled in the Virtual University of Pakistan's CS001 course, you're in the right place. Whether you're preparing for exams or si...

-

ACC501

Islamic 301, advertised by the Virtual College of Pakistan, centers on progressed Islamic thinks about, covering points like Islamic law, history, and...

-

MTH 202

MTH 202 MIDTERM, Last notes, counting both objective and subjective areas, outlined for Virtual College of Pakistan understudies. Our point by point n...

-

PSY 405

PSY 405 midterm with our comprehensive ponder materials! Our notes cover both objective and subjective questions, advertising nitty gritty clarificati...

-

MTH 100

Enhance your planning for the MTH 100 midterm with our comprehensive notes, counting both objective and subjective questions. Our materials offer poin...

-

CS 502

CS 502 MIDTERM Notes for Virtual College of Pakistan understudies, counting both objective and subjective questions. Our notes are planned to offer as...

-

MCM 401

MCM 401 MIDTERM Notes for the Virtual College of Pakistan? Our asset gives point by point objective and subjective notes, past papers, and fundamental...

-

STA 301

STA 301 MIDTERM, Last Notes for Virtual College of Pakistan understudies. These fastidiously created notes cover both objective and subjective questio...

-

MTH 632

MTH 632 MIDTERM Notes for the Virtual College of Pakistan. Our expertly curated notes cover both objective and subjective angles of the course, guaran...

-

MTH 643

MTH 643 MIDTERM Notes from Virtual College of Pakistan. Our notes cover both objective and subjective questions, advertising nitty gritty clarificatio...

-

MTH 603

MTH 603 MIDTERM Notes for Virtual College of Pakistan. Our notes cover both objective and subjective questions to offer help you surpass desires in yo...

-

CS 402

CS 402 MIDTERM Notes outlined particularly for Virtual College of Pakistan understudies. Our notes cover both objective and subjective questions, adve...

-

MGT 503

MGT 503 MIDTERM Notes (Objective and Subjective) - Virtual College of Pakistan Prepare successfully for your MGT 503 midterm exams with our compreh...

-

ENG 401

ENG 401 MIDTERM Notes (Objective & Subjective) – Virtual College of Pakistan Prepare reasonably for your ENG 401 midterm exams with our comprehensi...

-

MGT 624

MGT 624 MIDTERM Notes – Virtual University of Pakistan Elevate your exam preparation with our comprehensive MGT 624 MIDTERM Notes. These notes cove...

-

MGMT 623

MGMT 623 MIDTERM Notes - Virtual University of Pakistan Enhance your exam preparation with our comprehensive MGMT 623 MIDTERM notes, tailored speci...

-

EDU 101

EDU 101 MIDTERM Notes for Virtual College of Pakistan Get comprehensive EDU 101 MIDTERM notes, counting both objective and subjective questions, pl...

-

EDU 401

EDU 401 MIDTERM Notes for the Virtual College of Pakistan! Our nitty gritty notes cover both objective and subjective questions, guaranteeing you're w...

-

MTH 641

MTH 641 MIDTERM Notes from the Virtual College of Pakistan. Our notes incorporate both objective and subjective questions, advertising nitty gritty cl...

-

MGT 501

MGT 501 MIDTERM, Last notes, custom fitted particularly for Virtual College of Pakistan understudies. Our notes incorporate point by point objective a...

-

PAK 301

PAK 301 Notes (objective and subjective) custom-made for Virtual College of Pakistan understudies. Our notes are fastidiously made to cover key concep...

-

MTH 642

Open your victory in MTH 642 MIDTERM,FINAL with our comprehensive notes outlined particularly for Virtual College of Pakistan understudies. Our notes...

-

MTH 601

Looking for comprehensive MATH 601 MIDTERM, Last Notes custom-made for Virtual College of Pakistan understudies? Our point by point notes cover both o...

-

MGT601 Subject

The MGT601 centers on center administration concepts, counting organizational behavior, key administration, and authority. Key themes include: Orga...

Projects Overview

FIN622 – Corporate Finance

The course equips students with essential knowledge of financial principles including investment decisions, risk management, capital structure, and firm valuation. It focuses on corporate financial strategy for sustainable business growth.

Time value of money and present value concepts

Capital budgeting and project evaluation

Cost of capital and capital structure decisions

Working capital management

Risk analysis and financial planning

Dividend policy and shareholder value

Financial ratios and performance analysis

Corporate governance and ethics

Spreadsheet modeling for financial decisions